Taxpayer assistance is also available via email or by calling 1-800-MDTAXES. Taxpayers can schedule in-person or virtual appointments easily. Tax Practitioner Hotline (for Tax Professionals) Tax Fraud/Non-Compliance-Individual Taxes Sales and Use Tax Exemption Certificate Renewals (file and pay business taxes by telephone)

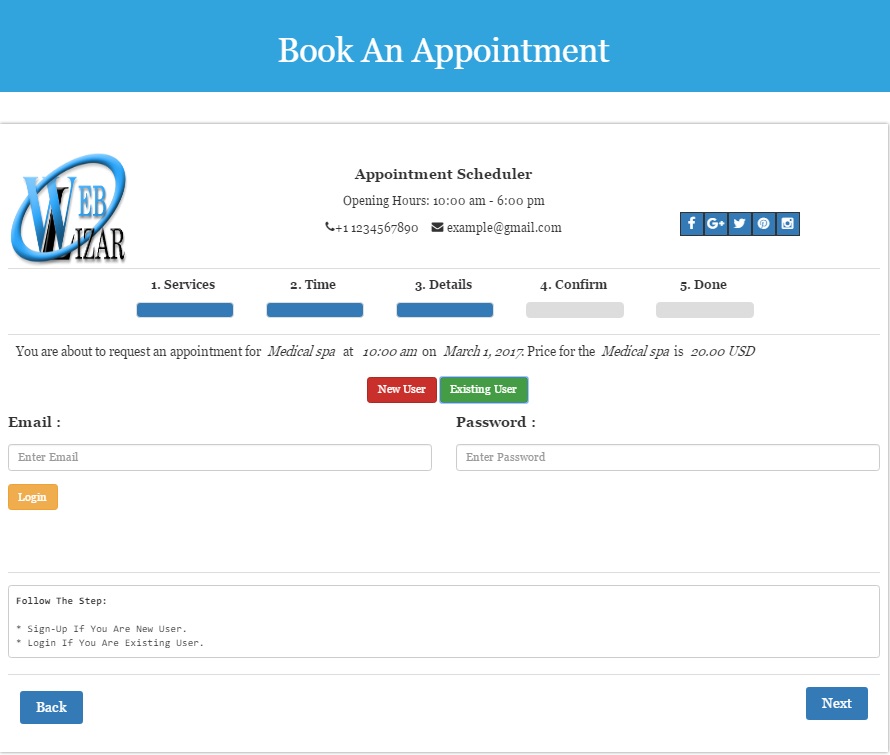

ATT APPOINTMENT SCHEDULER REGISTRATION

Contact ComplianceĬentral Registration Unit (for business taxes)ġ-800-MD-TAXES (1-80) from elsewhere in Maryland Note: After you send your original correspondence, please do not submit any W-2s, 1099 forms or any other documentation to us unless we specifically request you to do so. Please include your name, address, the last four digits of your Social Security number, CR or FEIN number and a daytime phone number in any correspondence that you send to us. Note that refund status is updated once daily at approximately 10:30 a.m. If you're calling about your Refund Status, you may use our automated line at 41 or 1-80. Phone agents are available to assist you with tax questions, business and personal account information. Telephone assistance is available 8:30 a.m.

You can expect a response within 2-3 business days.Į-mail your request for tax forms to Telephone AssistanceĬall 1-800-MD TAXES or 41 from Central Maryland. From February 1 - April 15, we experience extremely high email volumes.

This will help us generate a quick response to your inquiry. You can e-mail your tax questions to us at Please include your name, address and the last four digits of your Social Security number, or for business tax questions the Maryland Central Registration number (CR) or Federal Identification number (FEIN) in your e-mail message.

0 kommentar(er)

0 kommentar(er)